November 2012 GTA Commercial REALTORS® Release Monthly Commercial Market Figures

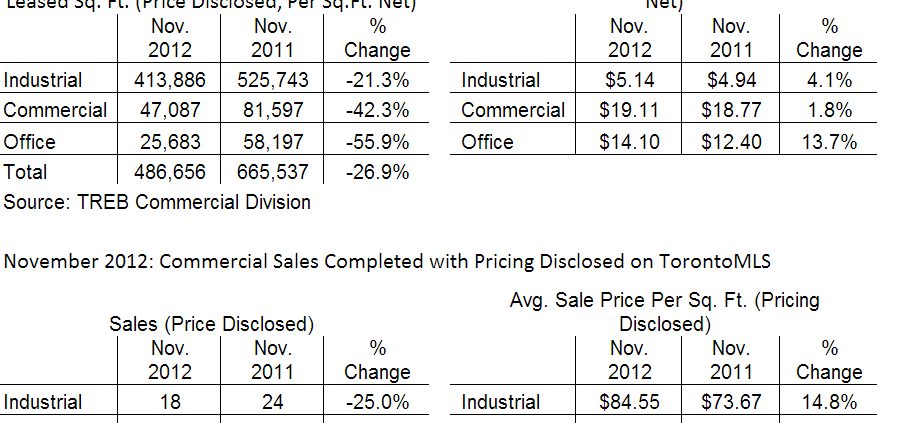

TORONTO, December 5, 2012 — Toronto Real Estate Board (TREB) Commercial Division Members reported 486,656 leased square feet of industrial, commercial/retail and office space through the TorontoMLS system in November 2012. This result was down by 27 per cent in comparison to November 2011.

Industrial properties accounted for 85 per cent of space leased, or 413,886 square feet – down by 21 per cent compared to last year. While the amount of industrial space leased was down year-over-year, the average lease rate for transactions undertaken on a per square foot net basis was up by four per cent to $5.14.

“A key theme in any discussion regarding the Canadian economy this year has been uncertainty. While economic growth in Canada continues to be driven by domestic consumer and business spending, growth in the export sector, which is so important to industrial concerns in the GTA, has continued to be anemic. Recession in Europe and slow growth in the United States and Asia have been at the root of this problem. This economic uncertainty has translated into less industrial space leased compared to a year ago, as some firms have put their real estate investment decisions on hold,” said TREB Commercial Division Chair Cynthia Lai.

There were 50 sales of industrial, commercial/retail and office properties in November 2012 – down by 19 per cent in comparison to November 2011. Sales were more evenly distributed by market segment, in comparison to the leasing market, with 36 per cent of transactions accounted for by industrial properties, 42 per cent accounted for by commercial/retail properties and 22 per cent accounted for by office properties.

The average selling price per square foot for transactions where pricing was disclosed was up on a year-over-year basis for industrial and commercial/retail properties, while the price was down for office properties.

“The year-over-year change in the average selling prices was likely due to a combination of a change in market conditions in some parts of the GTA compared to last year and a change in the mix of properties sold this year compared to last,” added Lai.

Source: TREB

Leave a Reply

Want to join the discussion?Feel free to contribute!